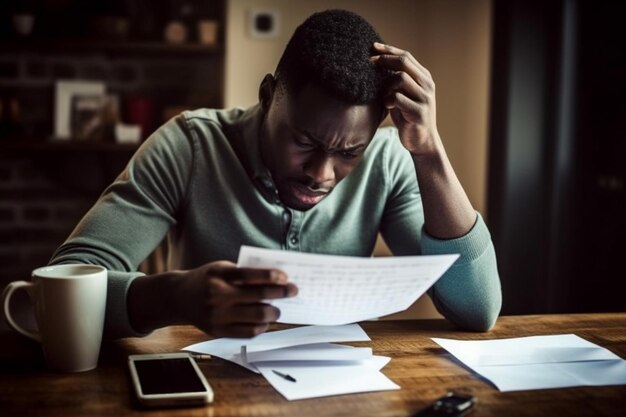

Breakdown of how October payslip looked like for employees after deduction of SHIF

The recent changes in October 2024 particularly the Social Health Insurance Fund (SHIF) brought new and adjusted deductions, impacting take-home pay significantly

The recent changes in October 2024 particularly the Social Health Insurance Fund (SHIF) brought new and adjusted deductions, impacting take-home pay significantly

- For a Sh100,000 gross salary, the final PAYE after relief was Sh21,097.85

- Total deductions amounted to Sh27,507.85 and the net pay was Sh72,492.15

- Introduction of Social Health Insurance Fund (SHIF) brought new and adjusted deductions in October 2024

October brought some notable changes to Kenyan payslips, with the recent introduction of the Social Health Insurance Fund, October payslips for employees took on a different look.

Here’s a detailed breakdown of how these deductions affect what employees actually take home, offering a clear picture of the impact on October’s net salary.

Working with a Sh100,000 gross salary figure, here is what the deductions and take home looked like.

Breakdown of deductions

1. Gross Salary: Sh100,000

This represents the total salary before any deductions are applied.

2. PAYE [Pay As You Earn]

PAYE is calculated progressively and adjusted by allowable deductions and tax reliefs:

Final PAYE after relief for someone earning Sh100,00 is Sh21,097.85

3. Social Health Insurance Fund Deduction

Following the enactment of the new Social Health Insurance Fund, 2.75% of the gross salary is deducted:

- Deduction = 100,000 * 0.0275 = Sh2,750

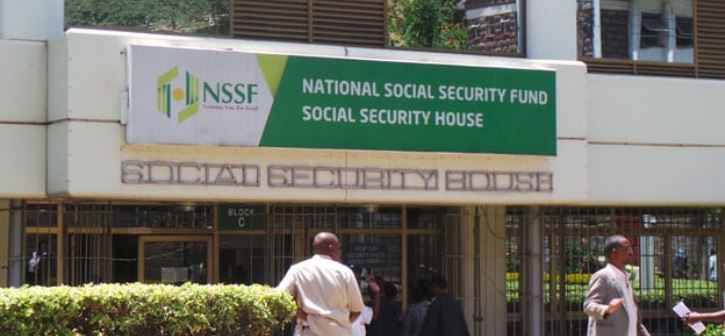

READ: How your February salary will look like after NSSF increases rates for 2024

4. Housing levy

The Housing Levy is calculated at 1.5% of the gross salary:

- Deduction = 100,000 * 0.015 = Sh1,500

5. National Social Security Fund [NSSF]

- Lower limit (Tier 1)

This tier applies to a lower contribution amount limit of Sh7,000. Both the employee and the employer contribute Sh420 each.

The total monthly contribution for Tier 1 is Sh840.

- Upper limit (Tier 2)

This tier applies to a higher contribution amount limit of Sh36,000. Contributions are calculated on the amount between the lower limit [Sh7,000] and the upper limit [Sh36,000], giving a base of Sh29,000.

Both the employee and the employer contribute Ksh 1,740 each.

- Tier I: Sh420

- Tier II: Sh1,740

- Total NSSF Deduction: Sh2,160

Total deductions Sh27,507.85 while the total net pay is Sh72,492.15.

| Deduction Type | Amount (Sh) |

|---|---|

| PAYE | 21,097.85 |

| NSSF (Tier I & II) | 2,160.00 |

| SHIF | 2,750.00 |

| Housing Levy | 1,500.00 |

| Total Deductions | 27,507.85 |